China Steel's April Steel Market Forecast Report,2020

China Steel's April Steel Market Forecast Report

1. Review of industry and market changes in March

In March, the spot price of steel products experienced a clear process of rising first and then falling, and the performance of each product was significantly different. Compared with the end of last month, the spot prices of rebar and wire rods have risen slightly, and the prices of medium and thick wires in plate materials have also risen month-on-month, while hot-rolled, cold-rolled, galvanized, and colored coatings have seen significant declines, falling by about 4% on average. The situation of strong building materials and weak boards is obvious. The main reasons are:

On the demand side: building materials are relatively less affected by the epidemic, and the plates are relatively large; the policies that can exert force are the areas that drive the demand for building materials;

On the supply side, the capacity utilization rate of short-process steel mills, which mainly produce building materials, is low; at the same time, higher scrap prices have supported the price of building materials;

Psychological expectations: policy factors have led the market to be relatively optimistic about the prospects of building materials.

2. Prediction of steel demand in April

Although the domestic epidemic is nearing its end, the foreign epidemic is still spreading. At present, it is not the steel fundamentals that affect the market trend, but the global epidemic control situation and the global macroeconomic situation. Due to the uncertainty of the external situation, the government is unlikely to introduce a strong stimulus policy recently. The real estate regulation and control policy will not be significantly loosened, because the city's policy and partial relaxation will continue. Steady growth in infrastructure will be intensified, and import and export will be the focus of government attention.

In terms of demand for construction steel, driven by policies, it is expected that infrastructure recovery will be relatively fast. Real estate is subject to policy constraints, and growth will slow.

In terms of steel demand for manufacturing, affected by the sluggish demand and the decline of foreign economies, the demand for plate materials may be significantly weakened.

In terms of exports, the current global epidemic situation is spreading, and exports are likely to decline significantly.

3. Prediction of steel supply situation in April

The reduction or growth of steel mills has formed a cycle with the trend of steel prices, and steel mills are not in a position to actively increase production restrictions. Only when the price drops to around 200 yuan / ton below the mill's cost line will the mill consider reducing production.

Although steel stocks fell better than expected, the situation of oversupply has not changed. The current steel inventory data does not have the true situation of market inventory, many of which are due to the warehouse being full. The large-scale replenishment of the downstream in the previous stage has also brought pressure on the inventory digestion in the later stage. It is expected that it will still be difficult to complete the effective digestion of inventory by June. High inventory in the later stage will be the norm.

Affected by the weakening demand caused by overseas epidemics, the situation of oversupply of iron ore will gradually manifest. Demand for iron ore is expected to decline in the later period, while supply is still increasing. It is expected that the price of iron ore will decline slightly in the second quarter and then drop significantly. Iron ore prices continue to fall by $ 10 / tonne.

The drop in iron ore and coke prices will reduce the cost of long-process steelmaking, and due to import restrictions and weak manufacturing, the decline in scrap prices will be smaller than that of iron ore, and the cost of short-process steel mills will still be higher than that of long-process steel Steel mill. Falling iron ore prices will reduce the capacity utilization rate of short-process steel mills again.

With the development of the epidemic, as the situation of oversupply of energy becomes more and more obvious, the price of coking coal and coke is likely to fall. The cost support of raw materials to steel prices will weaken.

4. Predicting the trend of steel market in April

We predict that in April, the steel market will face a complex situation of domestic demand recovery, rising steel mill output, falling overseas demand, and falling raw material prices. The situation of oversupply of steel will basically not change. It is expected that the steel market will continue to decline. . HRC and rebar are expected to fall around 200 yuan / ton and 150 yuan / ton.

The current market variables are still: the spread of foreign epidemics and how countries will respond, the resulting changes in trade policies, fiscal and monetary policies in various countries, and the response of capital markets. All these will affect the operation of the steel market.

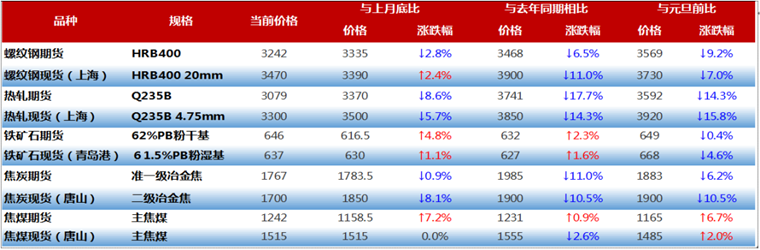

Drawing table:

![field:title/]](/uploads/220425/1-22042511053I30.jpg)

![field:title/]](/uploads/220414/1-220414214051492.jpg)

![field:title/]](/uploads/211104/1-211104121004V0.jpg)

![field:title/]](/uploads/211102/1-21110215254UP.jpg)

![field:title/]](/uploads/210923/1-2109231045325B.png)

![field:title/]](/uploads/200915/1-2009151K634949.jpg)

![field:title/]](/uploads/210813/1-210Q31QA0b0.jpg)

![field:title/]](/uploads/210629/1-2106291U944F9.jpg)