What is the gap between the Indian steel industry and China?

What is the gap between the Indian steel industry and China?

China and India are the two most populous countries in the world today, and China has about tens of millions more people than India. Steel production in China and India ranks first and third respectively in the world, with an annual production scale of more than 100 million tons, but China's crude steel output is about 8.5 times that of Indian crude steel.

Between 2006 and 2015, the apparent consumption of Chinese steel (crude steel equivalent) rose from 393 million tons to more than 70 million tons, an increase of 78.0%; in the same period, the apparent consumption of Indian steel increased from more than 49 million tons. It has grown by 82.0% to more than 89 million tons. In 2015, the apparent consumption of Chinese steel was about 7.8 times that of India. On a per capita basis, the apparent consumption of crude steel per capita in China in 2015 was more than seven times that of India.

Crude steel production comparison

In absolute terms, China's crude steel production has accounted for half of the world's total crude steel production, while India's crude steel production accounts for only about 6% of global production. Obviously, although India's crude steel output has surpassed that of the United States and ranks third in the world, China's crude steel output is more than eight times that of Indian crude steel.

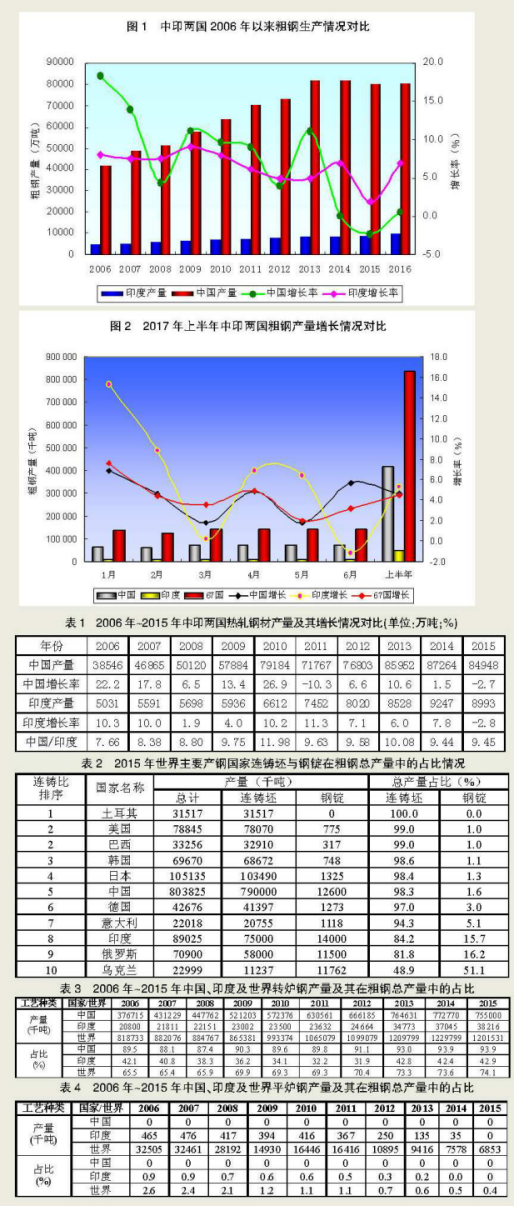

According to statistics released by the World Iron and Steel Institute (WSA), during 2006-2016, China's crude steel output increased from 421 million tons to 808.4 million tons, an increase of 92.0%, an average annual growth rate of 9.2 percentage points; India's crude steel output From 49.45 million tons to 95.62 million tons, an increase of 93.4%, an average annual increase of 9.3 percentage points; the ratio of China's crude steel production to Indian crude steel production decreased slightly from 8.51 times to 8.45 times. Obviously, roughly speaking, during this period, China's crude steel output and India's crude steel output have grown at the same time. India has a small base, which is 0.1 percentage points higher than China's, while China's steel output is still 8.5 times that of Indian steel. . In most of the period during this period, China's steel output was nine times or even more than 10 times that of Indian steel.

It can be seen from Figure 1 that the crude steel production in China and India has a relationship between growth and change in 2005-2016. Before 2011, China's crude steel output increased by more than India. Only in 2008, because China's steel industry suffered a financial turmoil this year, it was severely affected; while the growth of the Indian steel industry was relatively stable and moderate, and the degree of damage was relatively low. After 2012, China's crude steel output increased generally less than India. However, India’s steel production has not been stable and volatile since 2014.

In the first half of 2017, China's crude steel output in various months showed a volatility, which is a concrete manifestation of China's sustained economic growth and industry's positive development. At the same time, India's steel production has experienced a lot of shocks (see Figure 2).

Hot rolled steel production comparison

In terms of absolute quantity, China's hot-rolled steel production has accounted for more than half of the world's total hot-rolled steel production. From 2013 to 2015, China's hot-rolled steel production actually accounted for 53.3%, 53.0% and 53.2%, respectively. In the same period, India's hot rolled steel production accounted for 5.3%, 5.6% and 5.6% of the total global production. It is clear that India's hot rolled steel production is only about one-tenth that of China.

The World Steel Association's 2016 edition of the Steel Statistical Yearbook shows that from 2006 to 2015, China's hot rolled steel output increased from 385.5 million tons to 849.5 million tons, more than doubled, with a growth rate of 120.4% and an average annual growth of 13.4%. In the same period, India's hot rolled steel output increased from 50.31 million tons to 89.93 million tons, an increase of 78.8%, with an average annual growth of about 8.8%. The ratio of China's hot-rolled steel production to India's hot-rolled steel production rose from 7.66 times to 9.45 times. Obviously, during this period, China's hot-rolled steel output and India's hot-rolled steel production are growing rapidly, and China's annual growth rate is 4.6 percentage points higher than India's. At present, China's hot rolled steel output is about 9.5 times that of India's hot rolled steel. In 2010, China's hot rolled steel output was 12 times that of India (see Table 1 for specific data).

Comparison of crude steel product structure

As far as the current situation is concerned, China's crude steel products are advanced in structure and higher than the world average; India's crude steel products are backward in structure, far below the world average.

In the world's major steel-producing countries, the percentage of continuous casting billets and steel ingots in the total crude steel production, China's continuous casting billet accounted for 98.3%, with the United States, Japan and South Korea, the world's advanced level China's steel ingots account for 1.5% to 1.6%, which is also comparable to the US, Japan and Korea. However, India's crude steel products have a low level of structure and are clearly lagging behind in the world's major steel producing countries. (See Table 2 for specific data)

In the two years of 2014 and 2015, the percentage of crude steel slabs and ingots in the world's major steel-producing countries did not change significantly in the total crude steel output, and the ranking was almost unchanged. Among them, the proportion of continuous casting billet in China is stable at 98.3%, and the proportion of steel ingots fluctuates by 0.1 percentage point, from 1.5% to 1.6%. India's continuous casting billets accounted for 82.8% and 84.2%, respectively, up 1.4 percentage points; India's steel ingots accounted for 17.2% and 15.7%, respectively, down 1.5 percentage points. On the whole, although India's crude steel product structure is improving, it still has a gap of 12 percentage points from the world average, and the gap with China's continuous casting billet is as high as 14.1 percentage points.

Steelmaking process comparison

Comparing the steelmaking process in steel production between China and India, in general, China's steelmaking process is reasonable in structure and advanced in technology, in line with the world's steel production trends; India's steelmaking process structure is not reasonable enough, technology is relatively backward, and There is still a clear gap in the average level of world steel production.

Among the world's major steel-producing countries, converter steels in China, Japan, South Korea, Germany, Brazil, Russia and Ukraine account for a relatively high proportion of total crude steel production in all countries, both above 66%, while China's performance is even more Standing out, the proportion is over 90%. The electric furnace steels of a few countries such as Italy, the United States, Turkey and India account for a relatively high proportion of the total crude steel production in each country, both at around 60%, and the proportion of individual countries exceeds 70%. Among them, the proportion of China's converter steel and electric furnace steel was stable at 93.9% and 6.1% respectively; the proportion of converter steel and electric furnace steel in India increased from 42.4% to 42.9% and from 57.5% to 57.1%.

According to the data of the World Steel Association's 2016 edition of the Steel Statistical Yearbook, we have compiled and classified the output of converter steel and open hearth steel in China and India from 2006 to 2015 and their proportion in total crude steel production. The statistics are shown in Tables 3 and 4.

It can be seen from Table 3: First, in 2006, China's converter steel output was about 376.7 million tons, accounting for 89.5% of the total crude steel output; in 2015, China's converter steel output rose to about 755 million tons, accounting for coarse The ratio of total steel production also rose to 93.9%; during this period, China's converter steel output doubled, and the proportion of crude steel increased by 4.4 percentage points. Second, in 2006, India's converter steel output was 20.8 million tons, accounting for 42.1% of total crude steel production. By 2015, India's converter steel output rose to about 38.2 million tons, accounting for the ratio of crude steel production. It rose to 42.9%; during this period, India's converter steel output increased by 83.7%, and the proportion of crude steel increased by 0.8 percentage points.

It can be seen from Table 4: First, China has eliminated the open hearth steelmaking equipment. Between 2006 and 2015, China has not produced open hearth steel, and the total output and crude steel ratio are zero. Second, in 2006, the output of open hearth steel in India was 465,000 tons, accounting for 0.9% of the total output of crude steel. In 2014, the output of open hearth steel in India fell to 35,000 tons, accounting for 0.0% of the total crude steel output. In 2015, India stopped producing open hearth steel.

From 2006 to 2015, China, India and the world's electric furnace steel production and its proportion in the total crude steel output shows that in 2006 China's electric furnace steel output was about 44.2 million tons, accounting for 10.5% of total crude steel production. %; By 2015, China's electric furnace steel output rose to 48.8 million tons, accounting for 6.1% of total crude steel output; during this period, China's electric furnace steel output increased by 10.4%, and the proportion of crude steel decreased. 4.4 percentage points. In comparison, India's electric furnace steel output in 2006 was about 28.2 million tons, accounting for 57.0% of the total crude steel output. By 2015, India's electric furnace steel output rose to about 50.8 million tons, accounting for the total crude steel output. The ratio rose to 57.1%; during this period, the output of electric furnace steel in India increased by 80.3%, and the proportion of crude steel increased by only 0.1%.

Open hearth steelmaking is a backward steelmaking process that has been phased out in China and most of the world's steel producing countries, and it was not until 2015 that India completely stopped the process. This is enough to illustrate the backwardness of India's steel production technology and equipment.

Compared with electric steelmaking, converter steelmaking has high output, low cost and low energy consumption. Therefore, it is the development trend of global ordinary steel production. However, electric steelmaking using scrap steel as a raw material can better ensure the quality of steel, reduce costs and improve efficiency.

The crude steel production of the Indian steel industry is dominated by electric steelmaking, mainly due to its poor endowment and many human factors. In recent years, India's electric furnace steel production accounts for about 60% of its total crude steel output, and the highest proportion is close to 70%. However, due to the lack of scrap resources in India, the supply of scrap resources is tight and the quality is poor. At the same time, the energy shortage and energy supply instability caused by India's fragile energy infrastructure will further aggravate the dilemma faced by its electric furnace industry, which will directly affect the development of the country's steel industry.

![field:title/]](/uploads/220425/1-22042511053I30.jpg)

![field:title/]](/uploads/220414/1-220414214051492.jpg)

![field:title/]](/uploads/211104/1-211104121004V0.jpg)

![field:title/]](/uploads/211102/1-21110215254UP.jpg)

![field:title/]](/uploads/210923/1-2109231045325B.png)

![field:title/]](/uploads/200915/1-2009151K634949.jpg)

![field:title/]](/uploads/210813/1-210Q31QA0b0.jpg)

![field:title/]](/uploads/210629/1-2106291U944F9.jpg)